Starting January 1, 2024, the 2021 Corporate Transparency Act introduced a mandatory reporting of beneficial ownership information to be phased in over two years. ‘Covered entities’ must report details about their ‘beneficial owners’ to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and provide timely updates when information changes. To read our full article on who is considered a covered entity or a beneficial owner, click here.

Reporting of Personal Information Required

All covered entities that do not meet one of the 23 exceptions will be required to file an initial beneficial owner report with FinCEN. These entities will need to list anyone who meets the definition of a beneficial owner on their report and file an updated report each time information from the initial report has changed. Information the entity is required to include for each beneficial owner is listed below.

- Beneficial owner information

- Individual’s full legal name

- Date of birth

- Address

- Unique identifying number from one of the following nonexpired documents:

- U.S. passport

- State, local, or governmental identification card

- State driver’s license, or

- Foreign passport (if U.S. ID not available)

- An image of one of the above listed documents

Recommendations

For individuals who are considered a beneficial owner of a ‘covered entity’

To safeguard your information and reduce the number of people you are disclosing personal information to, we do not recommend providing the above information with copies of your driver’s license or passport to every covered entity for which you are a beneficial owner.

Instead, we recommend obtaining a FinCEN identifying number, which can be obtained by providing the above listed information directly to FinCEN, in exchange for them issuing you an identifying number. Instead of providing the above listed information to each covered entity, you would instead just provide each entity with your identifying number. If any of the above listed information changes, you are responsible for updating your information directly with FinCEN but will have no requirements to notify the entity of any changes since the identifying number will remain the same.

For Covered Entities who need to report beneficial owner information

To reduce the burden on covered entities with the requirement to request and ensure information obtained for beneficial owners is correct and secure, we recommend that covered entities do not request the above listed information from beneficial owners, but instead request all beneficial owners obtain an identifying number directly from FinCEN and provide just the identifying number to the entity.

Obtaining a FinCEN Identifying Number

- Click here to go to the FinCEN website to apply for a FinCEN identifying number.

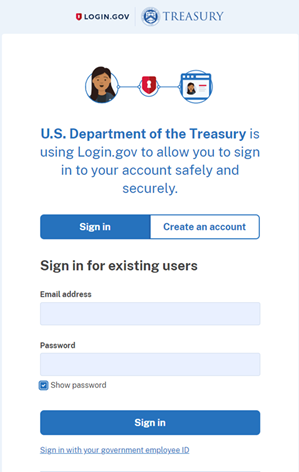

- Click on ‘Sign in or Create an Account with Login.Gov’.

- Click on ‘Login.Gov’.

- Sign in or create an account.

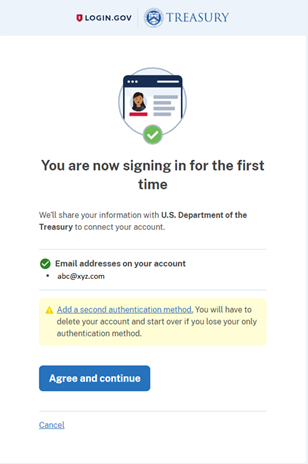

- To log in will require two-factor authentication, meaning it will text you a code to complete login.

- Click ‘Agree and continue’.

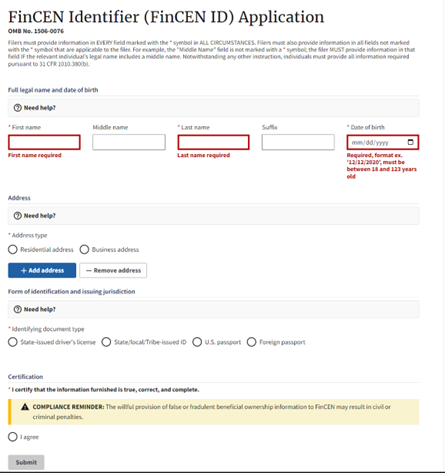

- Complete the application form below by entering the following:

- Legal first name

- Legal last name

- Date of Birth

- Select Residential Address and + Add address to enter your personal address information

- Select the form of ID that you believe will change less frequently.

- Enter the information from the ID and upload a copy.

- Click the ‘I agree button’ and ‘Submit’.

- Download and print the page for your records and make a note of your new FinCEN identifying number to provide to covered entities as needed.

No comments found.