The Bipartisan Budget Act of 2015 (BBA), P.L. 114-74 repealed the partnership audit provisions and introduced a new centralized audit regime for IRS audits of entities required to file Form 1065 ‘U.S. Return of Partnership Income.’

The BBA procedures changed the process for amending Form 1065 and the corresponding partner Schedule K-1 forms for tax years beginning on or after January 1, 2018. Partnerships that are subject to the BBA rules that need to file an adjustment to something previously reported on an original Form 1065 or Schedule K-1, must file an Administrative Adjustment Request (AAR).

On April 8, 2020, the IRS released Rev. Proc. 2020-23 which allowed eligible partnerships to file an amended return and issue amended K-1s, instead of filing an AAR, for 2018 and 2019 tax years. Entities utilizing the IRS relief provided by Rev. Proc. 2020-23 must have filed their amended return by Sept. 30, 2020.

Filing Process

If Filing Electronically:

- File Form 8082 ‘Notice of Inconsistent Treatment or Administrative Adjustment Request’ (AAR).

- Include a revised Form 1065.

- The partnership has a choice whether to pay the tax due on any imputed underpayment at the entity level or push the adjustments down to the underlying partners. If the adjustment does not result in an imputed underpayment, the partnership must push the adjustment down to the underlying partners.

- If the partnership elects to push out adjustments resulting to imputed underpayments to the underlying partners the following also needs to be filed:

- Form 8985 ‘Pass-Through Statement – Transmittal/Partnership Adjustment Tracking Report.’ This reflects the total adjustments being made at the entity level. This form is required to be signed by the partnership representative (PR). For electronic filing, the signed form needs to be attached in the tax software and transmitted electronically with the return. Electronic signatures are not accepted for Form 8985.

- Form 8986 ‘Partner’s Share of Adjustment(s) to Partnership-Related Item(s).’ This reflects each partner’s portion of the adjustments reported by the entity on Form 8985.

- To reflect that the entity is electing to push out the adjustment to its partners it should check the box in Part III, Section F box 2.

- If the partnership elects to pay the tax on any imputed underpayments at the entity level, see ‘Imputed Underpayment / Paying the Tax Due at the Entity Level’ section below.

- To reflect that the entity is electing to pay the tax on the imputed underpayment it should check the box in Part III, Section F box 1 and provide the information reflecting the additional tax, penalties and interest calculated, as well as indicate in either box 3 or 4 whether payment is being made electronically or by check. Part V should also be completed to include a detailed statement showing the calculation of the imputed underpayment.

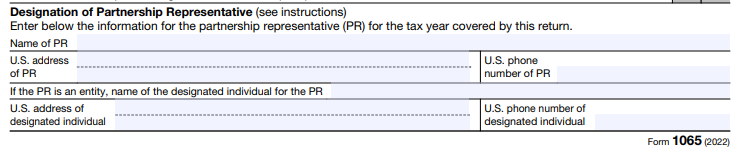

- Note the AAR must be filed by the partnership representative (PR). If a PR was not designated on the original Form 1065, one will need to be identified. Form 8979 ‘Partnership Representative Revocation, Designation, and Resignation’ will need to be included with the filing. Form 8979 needs to be signed by the new PR. For electronic filing, the signed form needs to be attached in the tax software and transmitted electronically with the return. Electronic signatures are not accepted for Form 8979. (Note that a partnership can use Form 8979 to revoke a previously designated PR and designate a new one).

- If the partnership elects to push out adjustments resulting to imputed underpayments to the underlying partners the following also needs to be filed:

If Paper Filing:

- File Form 1065-X ‘Amended Return or Administrative Adjustment Request’ (AAR).

- Include a revised Form 1065.

- The partnership has a choice whether to pay the tax due on any imputed underpayment at the entity level or push the adjustments down to the underlying partners. If the adjustment does not result in an imputed underpayment, the partnership must push the adjustment down to the underlying partners.

- If the partnership is pushing out the adjustments to the underlying partners the following also need to be filed:

- Form 8985 ‘Pass-Through Statement – Transmittal/Partnership Adjustment Tracking Report.’ This reflects the total adjustments being made at the entity level. This form is required to be signed by the partnership representative (PR). Electronic signatures are not accepted for Form 8985.

- Form 8986 ‘Partner’s Share of Adjustment(s) to Partnership-Related Item(s).’ This reflects each partner’s portion of the adjustments reported by the entity on Form 8985.

- If the partnership elects to pay the tax on any imputed underpayments at the entity level, see ‘Imputed Underpayment / Paying the Tax Due at the Entity Level’ section below.

- If the partnership is pushing out the adjustments to the underlying partners the following also need to be filed:

- Note the AAR must be filed by the partnership representative (PR), see screenshot above. If a PR was not designated on the original Form 1065, one will need to be identified. Form 8979 ‘Partnership Representative Revocation, Designation, and Resignation’ will need to be included with the filing. Form 8979 needs to be signed by the new PR. Electronic signatures are not accepted for Form 8979. (Note that a partnership can use Form 8979 to revoke a previously designated PR and designate a new one).

Imputed Underpayment / Paying the Tax Due at the Entity Level

- An entity filing an AAR must determine whether the adjustments requested to the original return result in an imputed underpayment.

- If an adjustment results in an imputed underpayment, the partnership must decide if it will elect:

- to push the adjustment down to the underlying partners, or

- calculate the tax assessment and pay it at the entity level.

- If an adjustment does not result in an imputed underpayment, the partnership must push the adjustment out to the partners.

- If the adjustment results in an imputed underpayment and the entity elects to pay the tax at the entity level, the entity needs to calculate and pay the following:

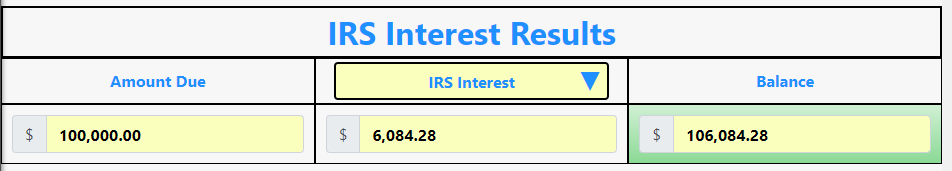

- Tax on the underpayment, calculated at a flat 37%. I.e. If the imputed underpayment was $100,000, then the tax the entity would need to pay would be 37% of $100,000 or $37,000.

- Penalties under IRC §6662, if applicable.

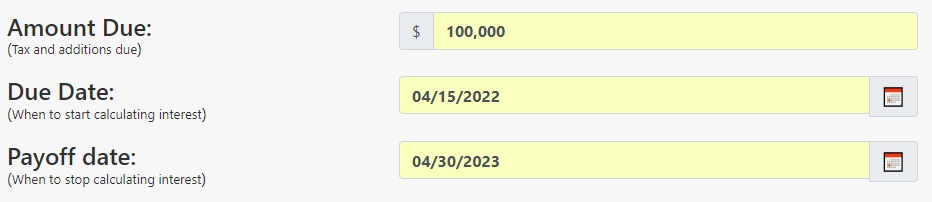

- Interest on the time-period from the date the tax payments would have been due for the underlying partners to the date the payment is being made. E.g. For a 2021 calendar year partnership return, the date to begin calculating interest is the date each underlying partner would have needed to pay their tax, e.g. April 15, 2022. If the entity is making the tax payment on the imputed underpayment on April 30, 2023, the period to calculate interest would be from April 15, 2022 through April 30, 2023. Note it is beneficial to the entity to make the payment as soon as possible and not wait until the filing due date to stop interest from accruing (see Due Date section below). E.g. If the AAR isn’t due until September 15, 2025, but the adjustment is known of in 2023, the payment can be made as soon as the imputed underpayment is known.

- To calculate the amount of interest due, use the IRS Interest Calculator.

Continuing with our example of an imputed underpayment of $100,000, we can see the total amount of interest due is $6,085.28 for a total balance due of $106,084.28

Dates to Disclose on the AAR

The following dates pertain to both Form 8985 and Form 8986 Part II:

- Review year is the tax year for which a change is being made. E.g. If an adjustment is being made to calendar year end tax year 2021, the Review Year date in Part II box D would be 12/31/2021.

- Adjustment year is the year the AAR is filed, not the year the adjustment is being made for. E.g. If an adjustment for 2021 is to be filed in 2023, then for a calendar year taxpayer, the adjustment year would be 2023 and the date reported in Part II box E would be 12/31/2023.

- Extended Due Date, regardless of whether the partnership has filed an extension, is the extended due date of the tax year the AAR was filed, i.e. the Adjustment Year. For a calendar year taxpayer whose Adjustment Year is 12/31/2023, the extended due date to be reflected in Part II, box F would be 9/15/2024.

- The date to be reflected in Part II box G should be the date the partnership furnished the Form 8986 to its partners and should be no later than the extended due date reported in box F.

Due Date for Filing AAR & Statute of Limitations

- An AAR may be filed for a tax year only if the partnership has already filed an original partnership return for that year.

- Unlike filing an amended return, a partnership filing an AAR under the BBA regime results in restarting the statute of limitations for all items with respect to that tax year.

- The due date to file the AAR (Form 8985) is the later of 3 years after:

- The date the return was originally filed, or

- The due date for filing the original return without regard to extensions.

E.g. For an adjustment to a return filed for tax year 2021 that was originally filed on Sept 15, 2022, the due date for filing the AAR would be 3 years after the later of:

- The date the return was originally filed for tax year 2021. Three years after Sept 15, 2022 = Sept 15, 2025.

- The due date for filing the return for tax year 2021 without regard to extensions. Three years after March 15, 2022 = March 15, 2025.

I.e. The later of the two is Sept 15, 2025, so the due date for filing the AAR in this example would be Sept 15, 2025.

Impact on Partners of a Partnership Filing an AAR

An entity filing an AAR should only provide Form 8986 to its underlying partners if:

- The entity is not paying the tax on any imputed underpayment at the entity level and is instead electing to push out the adjustments to the underlying partners.

- The result of filing the AAR does not result in an imputed underpayment, in which case the adjustments are required to be pushed out to the underlying partners.

No Form 8986 should be provided to the underlying partners if the partnership filing an AAR is electing to pay the tax on an imputed underpayment at the entity level.

Individuals or taxable entities that receive Form 8986 must calculate and pay any tax due with respect to their share of the AAR adjustments. This is done by computing the amount the partner’s tax would have been adjusted had their portion of the AAR adjustments been properly reported on the partner’s originally filed return for the review year. The partner should use Form 8978 ‘Partner’s Additional Reporting Year Tax.’ A change resulting in an increase in the partner’s tax will increase the partner’s tax for the reporting year. However, a change resulting in a decrease in the partner’s tax will create a nonrefundable credit. This credit can reduce the partner’s reporting year tax to zero but cannot generate a refund.

It doesn’t appear that overpayments of tax can be carried back or forward to be utilized in other years.

No comments found.